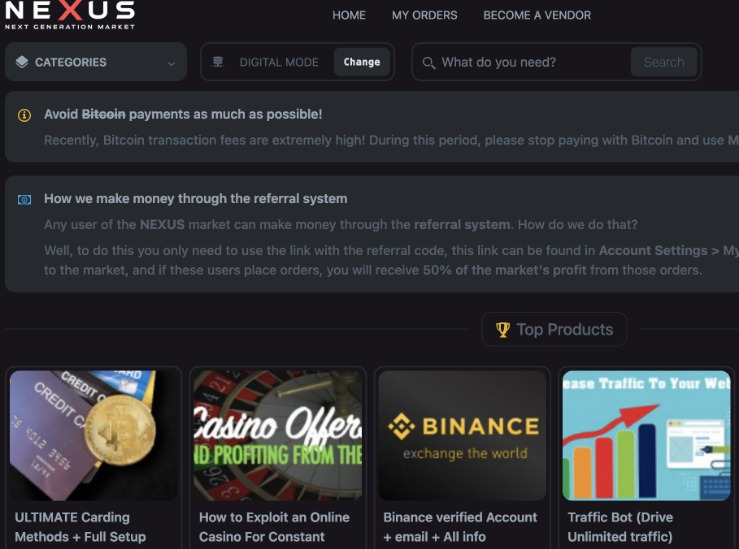

Nexus Market Link Overview

The Nexus Market Link plays a crucial role in connecting users to a secure and diverse marketplace platform. It serves as a gateway for accessing various products and services, offering a streamlined and confidential shopping experience. With a focus on safety and privacy, the Nexus Market Link ensures that users can explore numerous options without compromising their security. For those interested in exploring further, additional resources and related platforms are available through trusted connections such as nexus market links.

Definition of Nexus Market Link

The Nexus Market Link is a term used to describe a specialized connection or association within a marketplace ecosystem that facilitates transactions, communication, or data exchange between different entities. It plays a crucial role in creating seamless interactions and ensuring efficient operations within digital marketplaces. The nexus market link serves as a vital infrastructure component that helps to unify various platforms, vendors, and consumers by providing a reliable and secure pathway for information flow.

Understanding the concept of a nexus market link is essential for businesses aiming to optimize their marketplace strategies. This link acts as a bridge that enhances connectivity and integration, enabling smooth collaboration and transaction processing. Whether it’s for sourcing products, managing inventories, or processing payments, the nexus market link ensures that these activities are carried out efficiently and effectively. As marketplaces continue to grow and evolve, the importance of a strong and dependable nexus market link becomes increasingly apparent in supporting sustainable business operations.

Role in Sales Tax Collection

A nexus market link plays a crucial role in the realm of e-commerce and sales tax compliance. It serves as a digital connection that helps online businesses determine their obligation to collect and remit sales tax to various jurisdictions. As online sales grow across state and local borders, understanding how nexus market links function becomes essential for ensuring legal compliance and avoiding penalties.

In essence, a nexus market link is a technological or procedural pathway that establishes a connection between an online retailer and a specific tax jurisdiction. This link identifies whether the business has a taxable presence within a state or locality, based on factors such as inventory storage, economic activity, or other business operations. When a nexus market link exists, it triggers the retailer’s responsibility to accurately collect and report sales tax for sales made to customers in that area.

Effective use of a nexus market link streamlines the sales tax collection process, reducing compliance risks and administrative burdens for online businesses. It automatically assesses when and where sales tax should be applied, ensuring that businesses meet each jurisdiction’s unique requirements. This is especially important as evolving regulations and thresholds vary significantly across regions, making nexus determination a complex but vital aspect of modern e-commerce operations.

Overall, incorporating a reliable nexus market link into a business’s operations not only ensures adherence to legal standards but also builds customer trust through transparent and accurate tax practices. Staying updated on nexus definitions and leveraging technology to manage these connections can provide a competitive advantage in the rapidly expanding digital marketplace.

Registration Requirements for Nexus Market Link

Registering for a Nexus Market Link involves understanding specific requirements that ensure a secure and compliant marketplace experience. Prospective users must meet certain eligibility criteria and provide necessary documentation to verify their identity and business legitimacy. These registration requirements are designed to foster trust and safety within the Nexus Market environment. To get started, individuals and businesses should familiarize themselves with the detailed guidelines and ensure they meet all prerequisites before submitting their application for the Nexus Market Link. For more information, visit the official Nexus Market Link registration page and review the outlined criteria to simplify your onboarding process.

How to Register via MassTaxConnect

Registration requirements for the Nexus Market Link are essential for sellers looking to comply with state tax regulations and ensure smooth operations within the marketplace. Establishing a nexus with a state typically involves having a physical presence, significant economic activity, or other connections that obligate a seller to collect and remit sales tax. To facilitate this process, many sellers register through the state’s official platforms, such as MassTaxConnect, which streamlines the registration process and helps maintain compliance.

To register via MassTaxConnect, sellers must first create an account on the platform by providing basic business information including their federal EIN or SSN, business name, and contact details. Once registered, sellers can apply for a sales tax permit, which may be required if they establish nexus in the state or plan to sell taxable products or services within it. The registration process also involves specifying the types of products or services sold, which helps determine applicable tax rates and filing requirements.

After completing the registration, sellers can access the nexus market link to ensure they are properly registered for all relevant tax obligations. This link serves as a vital resource for managing tax filings, payments, and compliance requirements across different states. Proper registration through platforms like MassTaxConnect ensures that sellers adhere to state regulations, avoiding penalties and legal issues while expanding their market presence effectively.

Eligibility Criteria for Marketplaces

Registration requirements for the nexus market link vary depending on the specific marketplace or platform. Typically, sellers interested in listing their products through a nexus market link must complete a thorough registration process that includes providing accurate business information, contact details, and tax identification numbers. Ensuring that all submitted data is accurate and up-to-date is essential for smooth approval and ongoing compliance.

Eligibility criteria for marketplaces involving a nexus market link often require sellers to have a valid physical presence, such as a warehouse, office, or employees, within the relevant geographic region. Additionally, sellers may need to demonstrate compliance with local tax laws, licensing regulations, and industry standards. Many marketplaces also prioritize vendors who have a proven track record of reliability and quality in their products and services.

To qualify for participation through a nexus market link, businesses are usually asked to submit documentation supporting their eligibility, such as business licenses, tax certificates, and proof of address. Meeting these criteria ensures that vendors establish legitimacy and adhere to marketplace policies, fostering trust and transparency among buyers and sellers alike.

Understanding the registration requirements and eligibility criteria for a nexus market link is crucial for businesses aiming to expand their online presence. By fulfilling all necessary conditions, sellers can leverage the opportunities provided by marketplaces to reach a broader audience and grow their enterprise effectively.

Sales Thresholds and Nexus Determination

Understanding sales thresholds and nexus determination is essential for businesses navigating the complexities of state and local tax obligations. These concepts help establish when a company has a substantial connection with a taxing jurisdiction, thereby creating a tax obligation such as collecting and remitting sales tax. Accurate nexus determination ensures compliance with regulatory requirements and helps prevent potential penalties. For businesses exploring new markets, knowing how sales thresholds influence nexus status is critical to strategic planning. To learn more about establishing clear nexus connections and marketplace laws, visit nexus market link for detailed insights and resources that can guide your compliance journey.

Tracking Massachusetts Sales

Understanding sales thresholds and nexus determination is essential for businesses operating in different states, especially when it comes to tracking Massachusetts sales. Nexus, the connection between a business and a state, triggers the obligation to collect and remit sales tax. In Massachusetts, establishing nexus can depend on multiple factors such as physical presence, economic activity, or marketplace engagement. Monitoring sales levels in this state is crucial to ensure compliance with tax laws and to avoid penalties.

Massachusetts has specific criteria to determine whether a business has established nexus. These include:

- Physical presence, such as owning property, employees, or offices in Massachusetts.

- Reaching certain sales thresholds through economic activity within the state.

- Engaging with marketplace facilitators that facilitate sales into Massachusetts.

For online businesses, tracking Massachusetts sales becomes more complex, especially when sales thresholds are part of nexus determination. Once a business surpasses the designated sales volume or dollar amount within a calendar year, it is required to register for sales tax collection in the state. Businesses should utilize sales tracking tools to monitor their Massachusetts sales accurately and determine their nexus status.

Additionally, understanding the concept of a nexus market link is vital. It refers to the connection through which a company’s sales activity creates nexus in a particular state. Monitoring these links helps businesses identify when they need to comply with state tax laws, including registration and remittance. Staying informed about these thresholds and nexus rules ensures smooth compliance and helps avoid legal complications.

Regularly reviewing sales data and understanding the specific criteria Massachusetts uses to establish nexus are key for staying compliant. Businesses should consider consulting state resources or tax professionals to maintain accurate tracking and adhere to evolving regulations, ensuring they meet all legal obligations related to Massachusetts sales and nexus determination.

Thresholds for Mandatory Collection

Understanding sales thresholds and nexus determination is crucial for businesses operating across multiple states, as these factors directly influence the obligation to collect and remit sales tax. A nexus market link is established when a company’s physical presence or economic activity in a state meets certain criteria, making it necessary to comply with local tax regulations. Monitoring these thresholds helps businesses ensure they remain compliant and avoid potential penalties or audits.

Sales thresholds refer to specific monetary or transactional limits that, once exceeded, establish a nexus in a state. These thresholds vary by jurisdiction, but common examples include reaching a certain dollar amount of sales or the number of transactions within a given period. For instance, some states set a $100,000 sales threshold or 200 transactions annually. Once these limits are surpassed, businesses are required to register, collect, and remit sales tax in that state.

The determination of nexus involves evaluating both physical presence and economic activity. Physical presence may include having employees, inventory, or offices within the state. Economic nexus is often established through sales volume or transaction count, regardless of physical presence, especially following recent regulatory changes. Understanding these criteria helps businesses establish their nexus market link and stay compliant with state laws.

- Identify sales thresholds specific to each state: Regularly review state regulations as thresholds can vary significantly.

- Track sales and transaction data: Maintain accurate records to monitor when thresholds are approaching or exceeded.

- Evaluate physical presence: Determine if any physical assets or personnel in a state create a nexus.

- Assess economic activity: Analyze sales volume and transaction numbers to establish economic nexus.

- Register for sales tax collection: Once nexus is determined, proceed with registration to ensure legal compliance.

Staying aware of nexus market links helps businesses navigate complex sales tax obligations efficiently. By understanding and monitoring sales thresholds and nexus criteria, companies can maintain compliance and avoid potential penalties. For more detailed guidance, consult resources on nexus determination and thresholds for mandatory collection to ensure your business remains compliant in every state where it operates.

Implications for Marketplace Facilitators

Marketplaces operating within the digital economy face evolving legal and regulatory landscapes that significantly impact their operations. For marketplace facilitators, understanding the implications of nexus market link requirements is essential to ensure compliance and to optimize their business strategies. Nexus market link establishes a connection between a marketplace and the jurisdictions in which it operates, affecting tax collection, reporting, and other regulatory obligations. As the landscape continues to develop, facilitators must stay informed about nexus regulations and leverage resources such as nexus market link tools to effectively manage their compliance obligations and minimize legal risks. Navigating these complexities is crucial for maintaining a sustainable and compliant online marketplace ecosystem.

Responsibilities in Collecting and Remitting Tax

Marketplace facilitators play a crucial role in the modern e-commerce landscape, especially concerning their responsibilities in collecting and remitting sales tax. When a marketplace facilitator operates within a nexus market, there are specific legal obligations to ensure compliance with state tax laws. Nexus, which refers to a significant connection to a state, triggers the requirement for facilitators to handle the collection of sales tax on behalf of sellers. This means that if a marketplace facilitates sales in a jurisdiction where it has nexus, it must collect the appropriate tax from buyers and remit it to the state authorities. Understanding the implications of nexus for marketplace facilitators helps in avoiding penalties and ensuring smooth operations within legal boundaries.

One key responsibility for marketplace facilitators in a nexus market is establishing robust processes for determining where they have nexus and applying the correct tax rates accordingly. This involves staying informed about state-specific regulations and ensuring that the tax collection mechanisms are accurately integrated into the platform. Additionally, facilitators must keep detailed records of transactions to support tax remittance and compliance efforts. The concept of nexus market underscores the importance of understanding which jurisdictions are impacted by a facilitator’s activities, especially when expanding or operating across multiple states.

Furthermore, a nexus market imposes the obligation for facilitators to remit collected taxes regularly and in accordance with state deadlines. Failure to do so can result in fines, interest charges, or legal challenges. Therefore, marketplace facilitators should also invest in reliable systems for tax calculation, collection, and reporting to streamline the process. By effectively managing these responsibilities within a nexus market, facilitators not only comply with legal requirements but also foster trust with consumers and sellers, supporting sustainable growth in a competitive environment.

Communication of Collection Requirements to Sellers

Effective communication of collection requirements is essential for marketplace facilitators operating within nexus markets. As facilitators, it is crucial to clearly inform sellers about their tax collection obligations based on the jurisdictions where they have nexus, which is the connection that establishes tax collection responsibilities. Proper communication ensures compliance, reduces the risk of penalties, and promotes transparency in the transaction process.

Marketplace facilitators should provide sellers with detailed information about applicable tax rates, filing deadlines, and the scope of their collection responsibilities. This can be achieved through written guidelines, automated notifications, or dedicated support channels. Additionally, facilitators must stay informed about evolving nexus laws and ensure that their communication methods are updated accordingly to reflect current requirements.

Understanding the implications for nexus market link is vital for both facilitators and sellers. Facilitators need to clearly outline how the nexus market link influences tax obligations and the process for collecting and remitting taxes. Effective communication minimizes confusion and ensures sellers are aware of their responsibilities in each jurisdiction where they have nexus.

- In this instance, the person requesting the marketplace waiver must satisfy to DOR that the collection and remittance of tax will not be jeopardized.

- When terms such as “up to” or “from” are used to denote limits, achieving these maximum or minimum thresholds may be conditional on additional actions or fulfilment of certain criteria and requirements that may not be attainable by all clients.

- Depending on the nature of its presence in Massachusetts, a marketplace may be either a remote seller or an in-state (i.e., physically present) seller with respect to these direct Massachusetts sales.

- By creating an account, you acknowledge that PBS may share your information with our member stations and our respective service providers, and that you have read and understand the Privacy Policy and Terms of Use.

- If those Massachusetts sales exceeded $100,000 after November 1 of that year, the seller or marketplace is required to begin collection and remittance as of the 1st day of the 1st month beginning two months after the month in which the $100,000 threshold was exceeded.

Marketplace facilitators should also leverage technology to automate and streamline the dissemination of collection requirements. Implementing clear, user-friendly interfaces that outline seller obligations based on their nexus market link helps promote compliance and fosters trust among users. Ultimately, transparent and consistent communication about collection requirements supports a compliant marketplace environment and helps navigate complex tax landscapes efficiently.

Marketplace Seller Responsibilities Under Nexus Market Link

Marketplace sellers operating under the Nexus Market Link are responsible for ensuring compliance with various requirements to maintain smooth and legal transactions. These responsibilities include accurately representing products, adhering to marketplace policies, and maintaining security standards to protect buyer information. Understanding and fulfilling these duties is essential for sellers to build trust and sustain a successful presence within the Nexus Market Link platform. For additional resources on seller obligations and platform guidelines, visit Nexus Market Link and review the full seller responsibilities. Proper adherence to these guidelines helps foster a secure environment for both buyers and sellers, reinforcing the integrity of the marketplace.

Facilitated vs. Direct Sales

The Nexus Market Link platform serves as a vital connection point between marketplace sellers and customers, streamlining sales processes and ensuring compliance with relevant regulations. Sellers utilizing Nexus Market Link have specific responsibilities that vary depending on whether they are engaging in facilitated or direct sales. Understanding these distinctions is essential for maintaining proper legal and operational standards in the marketplace.

When operating under Nexus Market Link, sellers must be aware of their obligations to accurately report sales, collect appropriate taxes, and maintain transparency with customers. These responsibilities are particularly important when dealing with facilitated sales, where the platform often plays a role in handling transaction processes, and direct sales, where sellers manage transactions independently through the marketplace.

Managed correctly, sellers can leverage the benefits of Nexus Market Link to expand their reach while ensuring compliance with applicable laws. The primary responsibilities include:

- Accurately informing customers about product details, pricing, and shipping policies.

- Collecting and remitting applicable sales taxes based on the jurisdiction of the sale.

- Maintaining records of all transactions, including purchase details and payment records.

- Providing timely shipment and delivery of products in line with marketplace standards.

- Ensuring adherence to local, state, and federal regulations regarding online sales.

In the case of facilitated sales, the platform often acts as an intermediary, managing the transaction process on behalf of the seller. This means sellers need to ensure that their product listings are compliant and that they cooperate with platform mandates for tax collection and reporting. Conversely, with direct sales, sellers handle the entire process, making them responsible for all aspects of the transaction, from customer communication to compliance with tax laws.

By understanding the differences and responsibilities under Nexus Market Link, sellers can optimize their operations, stay compliant, and enhance customer satisfaction. Proper management of these duties is vital for fostering trust, avoiding penalties, and ensuring long-term success in the competitive online marketplace.

Use of Marketplace Facilitator Collection Certificates

Understanding the responsibilities of marketplace sellers under Nexus Market Link is essential for compliance and smooth operation within the marketplace environment. Nexus Market Link facilitates transactions between buyers and sellers, but it also requires sellers to meet specific tax and reporting obligations. Sellers are responsible for properly collecting, reporting, and remitting taxes on their sales to ensure adherence to state and local tax laws. This includes understanding whether they have a nexus in the buyer’s location, which might require them to register for tax collection purposes.

One critical aspect of marketplace seller responsibilities is the use of marketplace facilitator collection certificates. These certificates serve as a way for sellers to certify that a marketplace facilitator is responsible for collecting and remitting sales tax on their behalf. Proper use of these certificates can simplify tax compliance and reduce administrative burdens on individual sellers. When a seller uses a marketplace facilitator collection certificate, it indicates that the facilitator has agreed to handle the collection and remittance, which can impact how the seller reports sales and income.

Under Nexus Market Link, sellers must also stay informed about the specific policies related to tax collection and reporting. They should ensure they maintain accurate records of all transactions, certificates received, and tax collected. Furthermore, sellers are advised to regularly review their nexus status in different jurisdictions to determine their ongoing obligations. By effectively utilizing marketplace facilitator collection certificates, sellers can streamline their compliance processes and focus more on their core business activities.

Overall, being aware of and fulfilling marketplace seller responsibilities under Nexus Market Link supports legal compliance and fosters trust with customers and regulatory authorities. Sellers should always stay updated on any changes in tax laws or marketplace policies to ensure they meet all necessary requirements and avoid potential penalties or disruptions in their operations.

Waivers for Seller Collection Obligations

The nexus market link plays a crucial role in defining the responsibilities of marketplace sellers regarding tax collection and compliance. When operating within this framework, sellers must understand their obligations to ensure proper collection, remittance, and documentation of applicable taxes in various jurisdictions. In particular, the nexus market link serves as a digital connection that establishes a seller’s presence or economic activity within specific regions, thereby triggering tax collection responsibilities.

Sellers utilizing the nexus market link are often required to adhere to state and local tax laws, which may vary depending on the market’s geographic scope. However, there are certain waivers available that can relieve sellers from specific collection obligations under certain conditions. These waivers are typically granted if the seller can demonstrate that they do not maintain a physical presence or significant economic nexus in the jurisdiction where sales occur. Understanding these waivers is essential for sellers to ensure compliance while avoiding unnecessary tax collection duties.

It’s important for marketplace sellers to stay informed about changes in nexus laws and how the nexus market link affects their responsibilities. Properly managing these obligations helps prevent penalties and fosters transparent operations within the marketplace ecosystem. By leveraging the nexus market link effectively, sellers can streamline their tax compliance processes and focus on growing their business without jeopardizing legal compliance.

Tax Collection and Remittance Process

The tax collection and remittance process is a vital component of government fiscal management, ensuring that taxes are accurately collected from individuals and businesses and properly remitted to support public services and infrastructure. This process involves several steps, including registration, calculation of owed taxes, collection, and timely remittance to the relevant authorities. Efficient management of this process helps maintain compliance, reduces errors, and streamlines revenue generation. For those involved in cross-border transactions or operating within different jurisdictions, understanding the concept of a nexus market link becomes essential as it determines tax obligations based on the connection or presence within a specific taxing authority’s jurisdiction. To explore more about how nexus impacts tax obligations, visit the nexus market link platform for detailed insights. Additionally, leveraging tools and platforms that facilitate seamless tax remittance can significantly optimize the process, helping businesses stay compliant with evolving regulations.

Filing Frequency and Deadlines

The nexus market link plays a critical role in understanding the tax collection and remittance process for businesses operating across different jurisdictions. Establishing a nexus, or a significant connection with a state or local government, triggers the obligation to collect and remit sales taxes on taxable transactions. Once a nexus is established, businesses must follow specific procedures to ensure compliance with state laws and regulations.

Tax collection involves accurately calculating the sales tax owed based on the rate applicable in the customer’s location. After collecting the tax at the point of sale, businesses are responsible for remitting these funds to the appropriate taxing authority within designated timeframes. Proper remittance ensures compliance and avoids penalties or interest charges that can accrue due to late payments.

The filing frequency for sales tax returns depends on factors such as the volume of sales and the regulations of the state where the business has established a nexus. Common filing schedules include monthly, quarterly, or annually. Businesses should stay informed about their specific deadlines, which are typically aligned with the period they report and remit taxes, to avoid late filing penalties. For detailed guidance on managing these processes, businesses can refer to the nexus market link for comprehensive resources and updates.

To maintain compliance, it’s crucial for businesses to regularly review their nexus status and stay updated on changes in tax laws. Accurate record-keeping of sales and tax collected, along with timely filing and remittance, ensures smooth operations and adherence to legal requirements. Leveraging the right tools and resources, such as reputable nexus market links, can simplify this process and help businesses stay ahead of compliance obligations.

Making Payments through MassTaxConnect

The tax collection and remittance process is a crucial aspect of maintaining compliance for businesses operating within various jurisdictions. Proper management of this process ensures that taxes are accurately collected from customers and remitted to the appropriate tax authorities in a timely manner. For businesses engaging in remote sales or establishing a physical presence, understanding nexus and its implications is essential to determine tax obligations. A key tool for facilitating these transactions and managing tax payments efficiently is **MassTaxConnect**, a state-developed online platform designed to streamline tax filing and remittance processes.

Regarding nexus, it serves as the connection between a business and a taxing jurisdiction, establishing the threshold at which a business must collect and remit sales taxes. Having a physical or economic presence within a market creates a nexus market link, requiring businesses to comply with local tax laws. This link is vital for identifying where tax collection is necessary and ensuring accurate reporting and remittance.

The process of tax collection and remittance through MassTaxConnect involves several steps:

- Registration: Businesses must first register with the relevant tax authority and obtain a tax account number, often by creating an account on the MassTaxConnect platform if operating within participating states.

- Tax Collection: Once registered, businesses collect applicable sales taxes at the point of sale, based on the jurisdiction’s rate and regulations. The nexus market link helps identify the appropriate tax rates for each location where the business has a nexus.

- Reporting: Businesses regularly log into their MassTaxConnect account to report taxable sales and calculate the amount of tax owed. The platform provides tools to facilitate accurate reporting based on transaction data.

- Remittance: After submitting the sales tax report, businesses remit the calculated amount directly through MassTaxConnect. The platform streamlines payments, ensuring timely compliance with state requirements.

Understanding the nexus market link is fundamental for businesses to maintain compliance and avoid penalties. Leveraging online tools like MassTaxConnect simplifies the tax remittance process, providing a dedicated pathway to handle complex jurisdictional rules efficiently. Proper management of this process not only ensures adherence to legal obligations but also enhances overall business operations by reducing the risk of audit issues and fostering trust with consumers and authorities.

Handling Zero-Report Filings for Non-Taxable Sales

Understanding the tax collection and remittance process, especially when handling zero-report filings for non-taxable sales, is crucial for businesses operating within a nexus market. A nexus market link is the connection between a business and a tax jurisdiction that obligates the business to collect and remit sales tax. This connection can stem from physical presence, economic activity, or other criteria established by state laws. Maintaining compliance requires careful tracking of sales, including those that do not generate taxable income, to ensure accurate reporting and avoid potential penalties.

In the case of zero-report filings for non-taxable sales, businesses must submit regular reports indicating that no taxable transactions occurred within a specific period. The process involves documenting sales data and clarifying that those sales are exempt from taxation, which helps the tax authorities verify compliance and assess whether the nexus market link has been appropriately managed. Proper handling of zero reports ensures transparency and demonstrates good-faith compliance efforts, reducing audit risks and fostering trust with tax agencies.

It is essential for businesses to understand the specific requirements related to nexus market links to determine when and how to report sales accurately. Many jurisdictions offer guidance on zero-report filings, and leveraging technology tools can streamline this process by automatically categorizing taxable and non-taxable transactions. Staying informed and diligent in submitting correct filings not only maintains compliance but also supports efficient tax management and financial planning.

Special Considerations for Software and Digital Goods

Special considerations are essential when dealing with software and digital goods to ensure compliance, security, and a seamless experience for users. These products often involve unique distribution channels, licensing requirements, and updates that must be carefully managed. For businesses operating in this space, understanding the nuances can make a significant difference in both legal and technical aspects. Visiting a trusted marketplace like nexus market can provide valuable resources and a secure platform for acquiring and distributing digital products. To explore options further, consider checking the platform’s offerings and guidelines at nexus market link. Ensuring proper handling of digital rights, security measures, and delivery methods is crucial for success in this domain.

Taxation of Software Sales

Understanding the taxation of software sales is crucial for businesses operating across multiple jurisdictions, especially when considering nexus market link strategies. Nexus refers to the sufficient physical or economic connection a business has within a state or country that obligates them to comply with local tax laws. For digital goods and software, special considerations often apply due to the intangible nature of these products and the evolving legal landscape surrounding their taxation.

Taxation of software sales varies significantly depending on the jurisdiction. Some regions consider software as tangible personal property, subject to sales tax, while others treat it as a digital service or intangible good, exempt from certain taxes or taxed differently. When establishing a nexus, companies must analyze factors such as physical presence, economic activity, and digital connections to determine their tax obligations. A well-structured nexus market link strategy can help businesses identify where they have tax responsibilities and ensure compliance.

For businesses selling software or digital goods online, it is essential to stay updated on state and international regulations. Many jurisdictions have introduced or are considering specific rules for taxing digital products, including licensing fees, subscriptions, and upgrades. Managing these considerations carefully helps avoid penalties and ensures legal compliance. Developing a comprehensive nexus market link plan allows companies to optimize their tax positions and streamline their operational footprint, especially when expanding into new markets.

Facilitating Software and Subscription Sales

In the rapidly evolving digital economy, understanding the special considerations for software and digital goods is essential for effective sales and compliance. When facilitating software and subscription sales, it’s important to address key aspects such as licensing, delivery methods, and user experience to ensure seamless transactions and customer satisfaction. These digital products often require clear information about functionality, updates, and support, which can impact purchasing decisions and trust.

One critical factor in boosting sales and ensuring compliance is establishing a strong nexus market link. This connection helps businesses identify where their digital goods are being sold and consumed, supporting accurate tax collection and regulatory adherence. By leveraging a reliable nexus market link, sellers can better manage cross-border transactions, reduce liabilities, and optimize market reach while providing transparent and secure purchasing processes for consumers.

Additionally, when offering subscriptions for software or other digital services, it’s vital to present clear terms, renewal policies, and cancellation procedures. This transparency builds trust and encourages repeat business. Facilitating these sales through an effective nexus market link allows for streamlined transaction tracking, enhances compliance, and ensures that all legal obligations are met, particularly in jurisdictions with complex digital tax laws.

Ultimately, integrating a nexus market link into your sales process for digital goods not only simplifies regulatory compliance but also improves the overall customer experience, paving the way for sustained growth in the digital marketplace. Whether selling software, SaaS, or digital content, careful consideration of these factors is essential for long-term success.

Impact on Non-U.S. and Resale Entities

Understanding the impact of nexus market links on non-U.S. and resale entities is essential for businesses operating in a global marketplace. These links can influence how companies manage their supply chains, comply with international regulations, and optimize their resale strategies. By leveraging understanding of nexus market links, businesses can identify new opportunities and mitigate potential legal or tax challenges. For further insights, exploring resources such as nexus market link can provide valuable guidance on navigating these complexities effectively.

Requirements for Foreign Entities

The concept of a nexus market link is essential for understanding the tax obligations and compliance requirements that apply to non-U.S. and resale entities operating in different jurisdictions. A nexus refers to the level of connection or presence a business has within a state or country, which can trigger specific legal and tax responsibilities. For foreign entities engaging in sales activities that create a nexus in the U.S., compliance with local tax laws becomes necessary to ensure proper collection and remittance of sales taxes. Recognizing the factors that establish a nexus helps businesses determine whether they are subject to certain regulations and what steps to take to remain compliant.

Foreign entities must consider various criteria to establish a nexus, including physical presence, economic activity, and digital engagement. When a business meets the threshold for nexus, it may be required to register for sales tax permits, collect appropriate taxes, and submit filings regularly. The complexity of this process is heightened for resale entities, which often involve purchasing goods for resale purposes and may have different exemption rules. A thorough understanding of the nexus market link is crucial for foreign businesses to effectively navigate these requirements and avoid penalties.

- Determine the presence of a physical or economic nexus based on jurisdiction-specific rules.

- Register with local tax authorities once nexus is established.

- Collect, report, and remit sales taxes according to the applicable laws.

- Maintain accurate records of transactions and exemptions, especially for resale activities.

- Continuously monitor for changes in legislation that could affect nexus status or tax obligations.

By understanding the impact of the nexus market link on foreign and resale entities, businesses can proactively manage their compliance obligations. This strategic approach ensures smooth operations across borders and minimizes the risk of non-compliance, which can result in penalties, interest, or legal issues. Staying informed about nexus requirements is essential for maintaining a robust international business presence and optimizing sales processes within various markets.

Resale and Reseller Certificates

Understanding the impact of nexus on non-U.S. and resale entities is essential for businesses engaged in cross-border commerce. When dealing with nexus—a connection or physical presence within a taxing jurisdiction—companies must navigate complex sales and use tax regulations. For non-U.S. businesses and resale entities, establishing nexus can influence their tax obligations, registration requirements, and the use of resale and reseller certificates. Clarifying these factors is crucial for maintaining compliance and optimizing operations within the global nexus market.

One key consideration is how resale certificates are recognized and accepted across different jurisdictions. Resale and reseller certificates allow businesses to purchase goods without paying sales tax, provided the items are intended for resale. However, the acceptance of these certificates varies by location and depends on local tax laws. Entities should understand the specific requirements and documentation needed to leverage resale certificates effectively, especially when operating in multiple markets through the nexus market link.

- Determine Nexus Status: Businesses should assess whether their activities establish nexus in a particular jurisdiction by considering factors such as inventory storage, economic thresholds, or regular sales activity.

- Understand Local Tax Laws: Each jurisdiction has its own rules for sales tax collection, exemption, and resale certificate acceptance, making it vital to stay informed about local regulations via reliable nexus market links.

- Proper Documentation: Resale and reseller certificates must be correctly filled out and maintained to ensure enforceability and compliance, preventing potential tax liabilities.

- Register for Sales Tax Permits: Once nexus is established, registering for sales tax permits becomes necessary to legally conduct taxable transactions.

- Use of Resale Certificates in Cross-Border Transactions: When engaging with international partners, verifying the acceptance of resale certificates can help avoid unnecessary tax costs and delays in the supply chain.

For businesses involved in the nexus market, staying informed about the latest regulations and leveraging credible resources such as the nexus market link can be instrumental. This approach ensures compliance, minimizes risks, and helps optimize sales strategies by understanding the nuances of non-U.S. and resale entity requirements. Recognizing how resale and reseller certificates function across different markets is vital for maintaining smooth, compliant operations in an increasingly interconnected world.

Additional Guidance and Resources

Additional guidance and resources play a crucial role in understanding the best practices for optimizing your online presence. Whether you are new to digital marketing or seeking to enhance your existing strategies, accessing reliable tools and information can make a significant difference. The nexus market link offers a valuable resource for users looking to explore a wide range of products and services tailored to various needs. By utilizing this platform, you can find the support and connections necessary to grow your business effectively. For further insights and to access exclusive offerings, visit Nexus Market and discover how additional guidance can elevate your operations. Leveraging these resources ensures you stay informed and competitive in today’s dynamic digital landscape.

FAQs and Regulatory References

For businesses participating in the nexus market, understanding available additional guidance and resources is essential to ensure compliance and optimize performance. These resources provide valuable insights into regulatory requirements, best practices, and industry standards, helping stakeholders navigate complex legal landscapes effectively. Engaging with authoritative materials can also aid in identifying key areas for improvement and maintaining transparency.

Frequently Asked Questions (FAQs) related to the nexus market offer clarity on common concerns such as tax obligations, licensing requirements, and operational guidelines. Accessing well-structured FAQ sections can streamline decision-making processes and reduce uncertainties, fostering a smoother integration into the nexus market ecosystem.

Regulatory references serve as foundational tools for understanding legal obligations across various jurisdictions. By familiarizing oneself with relevant laws and directives, businesses can ensure compliance and mitigate risks associated with legal violations. Recognizing the importance of these references supports responsible market participation and fosters trust among consumers and regulators.

For those involved in the nexus market, leveraging comprehensive guidance and resources, including the nexus market link, is vital for informed and compliant operations. Staying updated with evolving regulations and utilizing available support tools will promote sustainable growth and uphold industry standards effectively.

Future Updates and Notifications from DOR

Understanding the importance of staying informed about the latest developments is crucial when navigating the nexus market landscape. Additional guidance and resources provided by the Department of Revenue (DOR) serve as valuable tools for businesses and individuals aiming to remain compliant and leverage new opportunities effectively. These resources include detailed guidelines, instructional materials, and expert insights designed to clarify complex regulations and streamline processes. Engaging with these materials can significantly enhance your ability to make informed decisions in a dynamic market environment.

Furthermore, DOR offers updates and notifications about future changes that could impact the nexus market. Subscribing to these updates ensures you receive timely information on regulatory adjustments, policy revisions, and new initiatives. Staying ahead of these changes helps in maintaining compliance and adapting strategies proactively. The nexus market link, positioned as a key resource, provides comprehensive access to relevant updates, ensuring that stakeholders are well-equipped to manage their operations effectively in an evolving regulatory landscape.